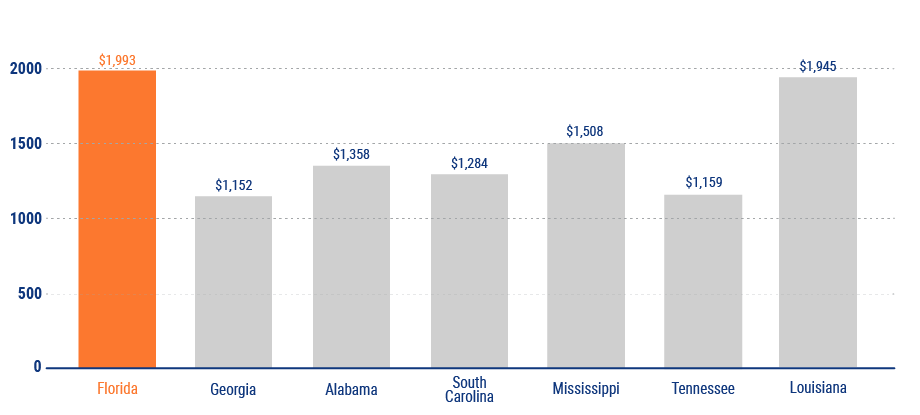

Average Cost of Homeowners Insurance in Florida

The average American homeowner pays $1,173 per year for home insurance, but in Florida, the average annual premium is $1,993, making it the most expensive state in which to buy home insurance. Even though insurance is more expensive for homes in Florida, having insurance is vitally important because hazards such as severe storms and raging wildfires can cause serious damage to homes each year.

Average Price for Homeowners Insurance