When running a shoe store, there are many different things that demand your attention at all times, not just your customers. Like any other kind of business, shoe stores are at risk of numerous threats on a daily basis. Fortunately having adequate shoe store insurance can seriously help mitigate these risks.

Even better, a Florida independent insurance agent can help you find the right kind of shoe store insurance for your unique business. They’ll even get you equipped with that coverage long before you ever need to file a claim. But first, here’s a deep dive into this important insurance.

What Is Shoe Store Insurance?

Shoe store insurance is a specialized form of Florida business insurance intended to meet the needs of shoe store owners. Combined with the basics of a business insurance package, shoe store insurance comes with several additional coverages that cater to your shoe store. Depending on the risks and operations of your specific business, your policy may vary from other shoe stores. A Florida independent agent can help you assemble your package.

What Does Shoe Store Insurance Cover in Florida?

Shoe stores will select their coverages from a big list of available options, but there are several forms of coverage typically included in standard policies no matter what. Some of the most common include:

- Commercial property: Protects your shoe store’s building or office and inventory from disasters like fire and more.

- Workers’ compensation: Protects your crew from injury, illness, or death on the job.

- Commercial general liability: Protects your shoe store against lawsuits filed by third parties for claims of personal property damage or bodily injury by your business.

- Business income: Protects your shoe store from loss of revenue and employee wages during temporary shutdowns or suspensions of operations due to covered perils.

Working with a Florida independent insurance agent is your best bet to ensure your shoe store gets set up with all the essential core coverages it needs.

Recommended Additional Coverages for Shoe Stores in Florida

After your shoe store gets equipped with common coverages needed by all businesses, it’s time to handpick the extra coverages it needs with the help of your Florida independent insurance agent. According to insurance expert Paul Martin, shoe stores can choose from the following additional coverage options and more:

- Crime insurance: Coverage guards your shoe store against an employee or criminal theft of its income.

- Cyber liability insurance: Coverage guards your shoe store against theft of your electronic data and sensitive information like credit card numbers from criminals.

- Commercial auto insurance: Coverage guards your business’s vehicle fleet against theft, storm damage, and more. A personal auto insurance policy will not cover your business vehicles.

- Commercial umbrella insurance: Coverage under a commercial umbrella insurance policy can increase your shoe store’s liability protection.

This list of additional coverage options is far from exhaustive. Your Florida independent insurance agent will recommend other coverages if they feel they’re the right fit for your shoe store.

Shoe Store Stats

Shoe stores and other clothing outlets are just one niche of the retail industry in the US. It’s helpful to know where shoe stores specifically fall, income-wise, compared to other types of retail businesses when selecting your coverage.

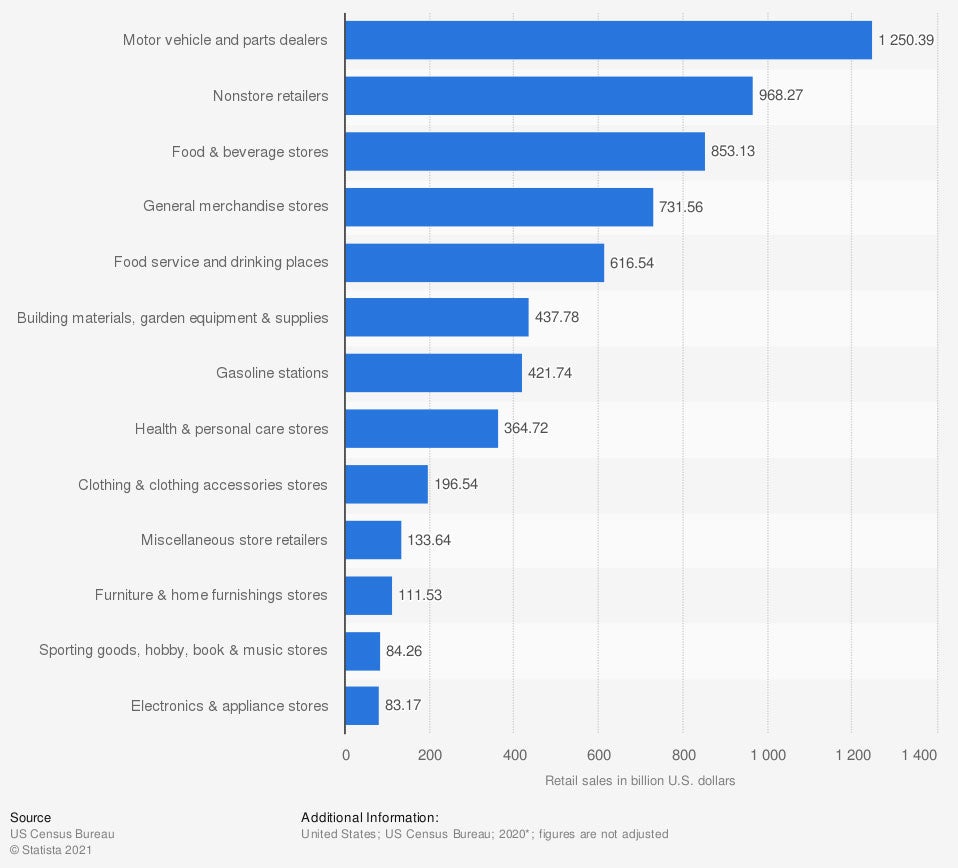

Annual retail sales in the United States in 2020, by store type (in billion US dollars)

In 2020, motor vehicle and parts detailers generated $1.25 trillion in revenue. Food and beverage stores brought in $853.13 billion, and general merchandise stores brought in $731.56 billion. Clothing and clothing accessory stores ranked a bit further down the list, generating $196.54 billion in revenue.

A Florida independent insurance agent can help your shoe store get equipped with the appropriate coverage to guard against the associated risks for your industry niche.

What Doesn’t Shoe Store Insurance Cover in Florida?

Martin said that while shoe store insurance provides a lot of important coverage, it also comes with its own set of exclusions, like:

- Routine maintenance costs

- Nuclear or war damage

- Employee dishonesty

- Flood damage

In a state like Florida, which can get hit with some heavy flooding events, it’s critical to consider adding a separate flood insurance policy. Business insurance does not cover natural flood damage. Your Florida independent insurance agent can help you find flood coverage and others that may benefit your shoe store.

How Much Does Shoe Store Insurance Cost in Florida?

Some shoe stores might pay only a couple hundred dollars per year for coverage, while others might pay several thousand or even more for their coverage. Your premium’s cost all depends on a number of different factors, like:

- The size of your team

- Your business’s risks

- Your specific location

- The size of your business

- The amount of revenue you generate

Your Florida independent insurance agent can help you find exact quotes for your area, as well as scout out any discounts you may qualify for.

Will My Location Impact My Rates?

Yes, your shoe store’s location does impact your premium rates for coverage. Shoe stores along one of the coasts of Florida could pay up to 15% more for coverage than those in central Florida, due to the increased risk of storm damage, such as from hurricanes.

Also, if your business is located in a larger city like Miami, you might pay more for coverage than if you were located in a smaller town in, say, Citrus County. Larger cities usually have higher costs for property coverage due to increased threats of crimes like theft and vandalism, as well as higher property values in general.

Here’s How a Florida Independent Insurance Agent Can Help

When it comes to protecting shoe store owners against liability risks, property damage, and all other disasters, no one’s better equipped to help than an independent insurance agent. Florida independent insurance agents search through multiple carriers to find providers who specialize in shoe store insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

graph - https://www.statista.com/statistics/289776/us-retail-annual-sales-store-type/

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/insurance-for-specific-businesses/small-retail-stores

© 2024, Consumer Agent Portal, LLC. All rights reserved.