Owners of successful retail stores have to keep a number of things in mind at all times, including many potential threats to their business. Having the right coverage is key to avoiding many kinds of devastating disasters. Fortunately getting equipped with adequate retail store insurance can seriously help.

Florida independent insurance agents can help you find the right kind of retail store insurance for your unique business. They’ll also get you equipped with the proper coverage long before you ever need to file a claim. But before we jump too far ahead, here’s a closer look at this important coverage.

What Is Retail Store Insurance?

Retail store insurance is essentially a special form of Florida business insurance designed to meet the needs of retail store owners. This coverage includes the basics of business insurance and can be then be customized with additional coverages that apply to your specific retail store. So a policy for a hardware store might look quite a bit different from a policy for a souvenir store. A Florida independent agent can help you assemble your package.

What Does Retail Store Insurance Cover in Florida?

While retail store insurance policies can vary greatly depending on the business, there are several basic coverages that apply to most packages. Some of the most common coverages included in retail store insurance are:

- Commercial general liability: All types of retail stores need liability protection against lawsuits filed by third parties for claims of bodily injury or property damage.

- Commercial property: Retail stores need protection for their physical office structure as well as their inventory from disasters such as fire and more.

- Workers’ compensation: Business owners also need protection for their employees in case they get injured, ill, or die due to work-related activities.

- Business income: All retail stores also need to have protection for their revenue. Business income coverage helps reimburse retail stores for lost income and wages during temporary closures due to covered perils, like fire, natural disasters, etc.

A Florida independent insurance agent can further explain the core coverages often included in retail store insurance packages.

Additional Coverages for Retail Stores in Florida

Once the basic coverages for your retail store are accounted for, you’ll work with your Florida independent insurance agent to customize your package further for your unique business. According to insurance expert Paul Martin, there are several optional coverages that retail store owners can choose from, including:

- Commercial auto insurance: Retail stores that have vehicles for work purposes such as deliveries need commercial auto insurance to protect their fleet against theft, storm damage, and more.

- Crime insurance: This coverage is important to guard retail stores against employee or criminal theft of their income.

- Cyber liability insurance: All businesses today need to consider cyber liability coverage to guard their electronic data from criminals.

- Commercial umbrella insurance: Retail stores that may have greater legal exposures should consider commercial umbrella insurance to increase their liability protection.

Your Florida independent insurance agent can help you determine which coverages most benefit your specific retail store.

Retail Store Stats

Though retail stores of all kinds need coverage, it’s helpful to know which types benefit from having the most coverage, due to their risk level. Check out some stats for retail stores in the US to better gauge the level of protection your unique business requires.

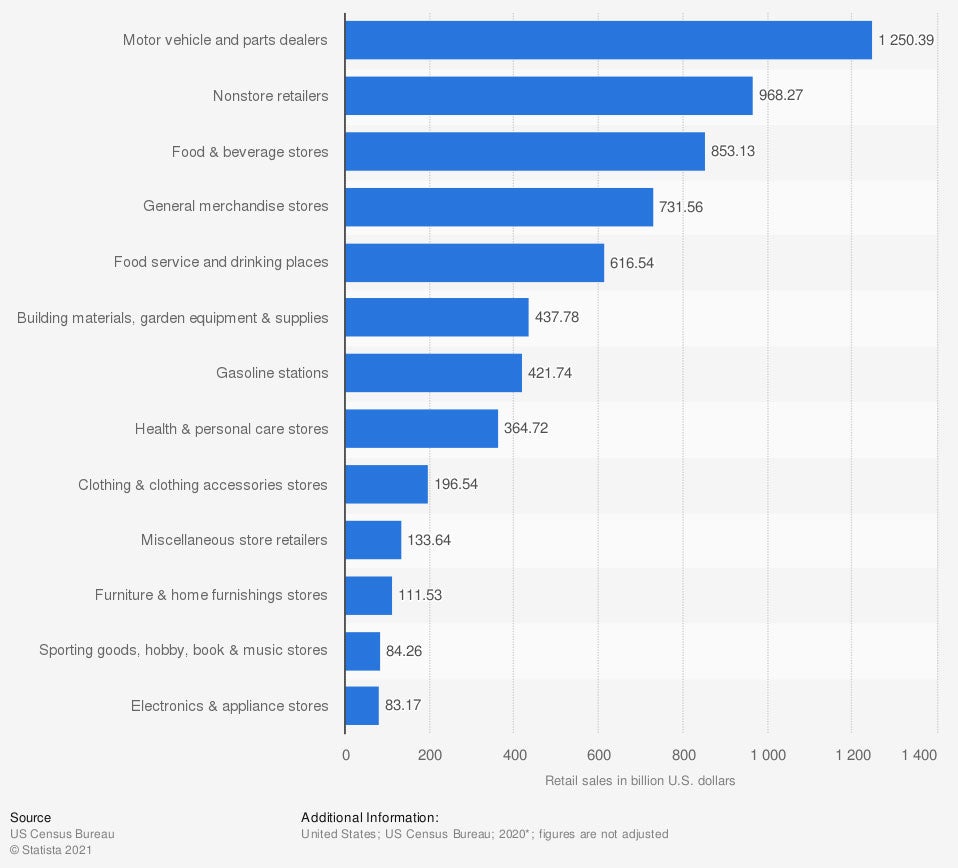

Annual retail sales in the United States in 2020, by store type (in billion US dollars)

In 2020, motor vehicle and parts dealers generated $1.25 trillion in revenue. Food and beverage stores brought in $853.13 billion, and general merchandise stores brought in $731.56 billion.

A Florida independent insurance agent can help explore the needs of your business’s unique niche and get you set up with all the appropriate coverage to guard against the associated risks.

What Doesn’t Retail Store Insurance Cover in Florida?

Retail store insurance provides many important coverages for business in Florida, but like all other kinds of insurance, it also comes with its own set of exclusions. Martin says the most common coverage exclusions for retail store insurance are:

- Employee dishonesty

- Routine maintenance

- Nuclear or war damage

- Flood damage

In a state like Florida, it’s extremely important to consider adding flood insurance to your retail store coverage. Flood insurance is a separate policy that your Florida independent insurance agent can help you find. Business insurance does not cover natural flood damage.

How Much Does Retail Store Insurance Cost in Florida?

The cost of your retail insurance policy will depend on a number of factors. Some stores might pay only a couple hundred dollars annually for coverage, while others might pay several thousand or even more.

Your retail store insurance will be determined by reviewing the following factors:

- The size of your business

- Your business’s annual revenue

- The number of employees you have

- Your business’s unique risks

- Your specific location

Your Florida independent insurance agent can help review the factors that influence your retail store insurance package’s cost, as well as find exact quotes for your area.

Will My Location Affect My Retail Store Insurance Rates?

Yes, your specific location impacts the cost of your retail insurance policy in a few ways. If your retail store is located along one of the coasts of Florida, you might pay up to 15% more for coverage than retailers in central Florida, due to the increased risk of hurricane damage.

If your business is located in a larger city like Miami, you might pay more for coverage than if you were located in a smaller town. Larger cities tend to have higher costs for property coverage and increased threats of crimes like theft and vandalism.

Here’s How a Florida Independent Insurance Agent Can Help

When it comes to protecting retail store owners against liability risks, property damage, and all other disasters, no one’s better equipped to help than an independent insurance agent. Florida independent insurance agents search through multiple carriers to find providers who specialize in retail store insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

graph - https://www.statista.com/statistics/289776/us-retail-annual-sales-store-type/

iii.org

irmi.com

© 2024, Consumer Agent Portal, LLC. All rights reserved.