Responsible renters have to anticipate all kinds of potential disasters that could happen in their home ahead of time. Planning and preparing for success in the very beginning can seriously help eliminate stress down the road. That’s why it’s so important to be equipped with the right Florida renters insurance.

Florida independent insurance agents can help you find the renters insurance policy that works best for you. They’ll get you set up with the coverage you need, long before you ever actually need to use it. But before we get too far ahead of ourselves, here’s a deep dive into this crucial coverage.

What Is Renters Insurance?

Renters insurance in Florida, like anywhere else, is a contract between an insurance company and an individual in which the insurer agrees to cover certain financial losses from liabilities and damage on the rented property. Renters insurance comes with certain covered and excluded perils, defined in the policy. Coverage is designed to help renters hold onto their stuff and their home in case of a catastrophe.

What Does Renters Insurance Cover in Florida?

Renters insurance has many similarities to homeowners insurance, but also one major difference. Renters insurance does not cover the dwelling of the home, since it belongs to the landlord of the property. Though renters insurance provides a lot of other important coverages.

Renters insurance in Florida usually covers the following:

- Your personal property: Like clothing, furniture, etc. that’s stored in your rented property, against perils like fire, theft, etc.

- Your legal exposures: Liability insurance included in renters policies reimburses for legal expenses in the event of a lawsuit filed against you by a third party.

- Your additional living expenses: If a covered peril forces you to temporarily live elsewhere while waiting on repairs to your home, renters insurance pays for many additional costs like extra gas mileage, meal takeout, and more.

A Florida independent insurance agent can further explain the core coverages included in standard renters insurance policies.

What Doesn’t Renters Insurance Cover in Florida?

Though renters insurance provides a ton of important protection, it comes with its own set of exclusions, just like all other coverages. According to insurance expert Paul Martin, some of the main exclusions in renters policies are:

- Insect damage or infestations

- Damage from war or nuclear fallout

- Business-related liability

- Floods, earthquakes, and mudslides

- Maintenance-related losses

- Wear and tear damage

Talk to your Florida independent insurance agent about business riders or endorsements if you run a business out of your home. It’s also a good idea to work with them to look into a separate flood insurance policy, especially in a flood-prone state like Florida.

How Much Is Renters Insurance in Florida?

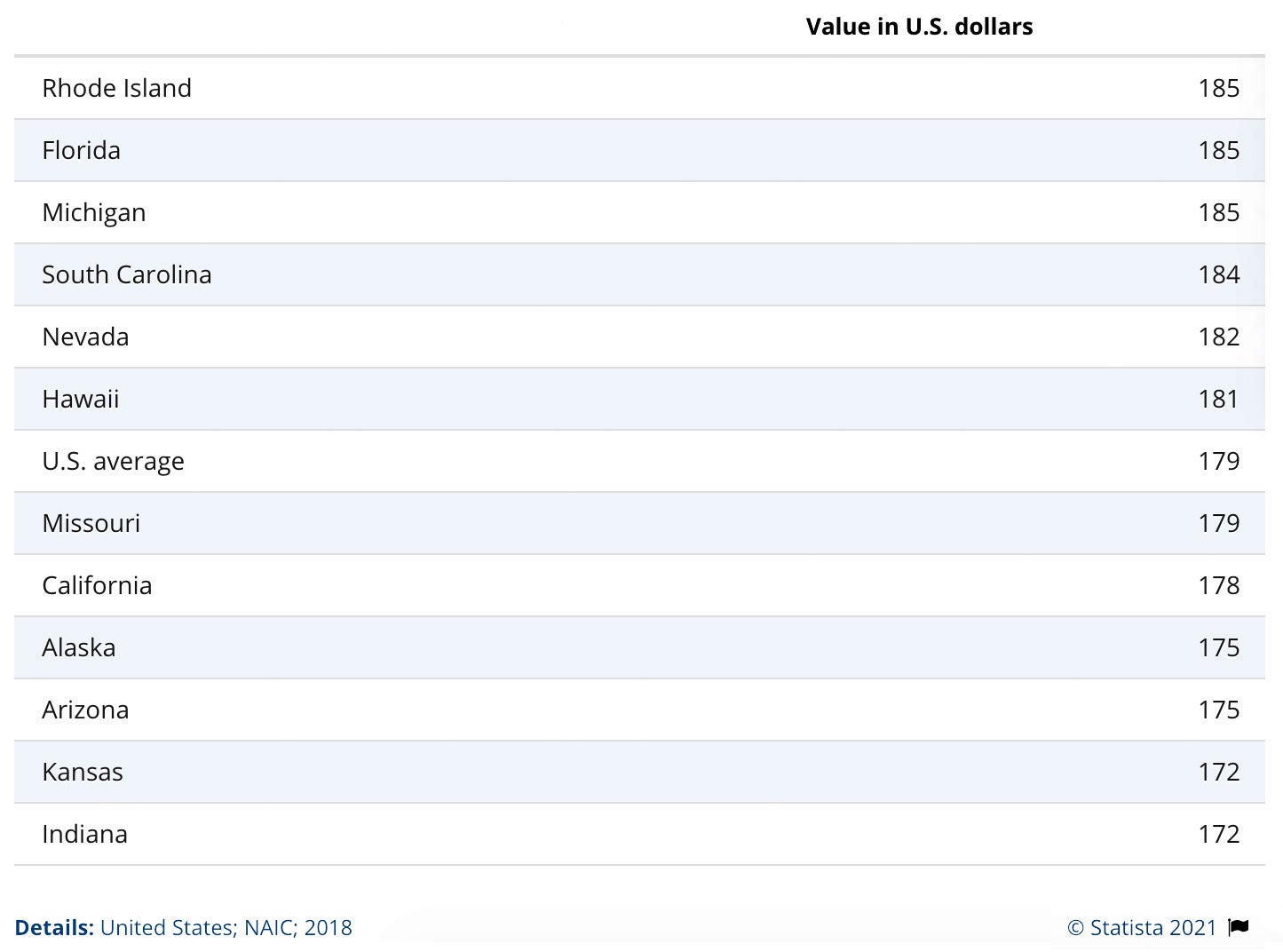

Value of average renters insurance premiums in the United States in 2018, by state

(in U.S. dollars)

In 2018, Florida’s premiums for renters insurance ranked 15th-most expensive overall for the US. The average annual renters insurance premium for Florida residents was $185 that year.

The cost of your renters insurance policy will vary depending on where exactly you’re located, and the value of the property you’re renting. Renters in Miami are likely to pay a lot more for coverage than residents in a much smaller town, like Citrus Springs. Your Florida independent insurance agent can help you find exact figures and quotes for your area.

Is Renters Insurance Really Necessary in Florida?

Having renters insurance is always a good idea, whether it’s technically mandatory or not. However, many landlords require their tenants to carry renters insurance before their lease can begin. Renters insurance is important to protect not only your belongings, but also your peace of mind in case of numerous potential disasters.

What Are Other Benefits of Renters Insurance?

Aside from the obvious, renters insurance policies in Florida provide coverage for many common threats to the home. These include:

- Windstorms, hail, lightning, and blizzards

- Theft, vandalism, riots, and civil commotion

- Fire, smoke, and explosions

- Certain types of water damage

- Aircraft or vehicle damage

- Falling objects and trees

Your Florida independent insurance agent can help you review your renters insurance policy to answer any remaining questions about your coverage. They’ll also be able to help you figure out whether you’ve got enough coverage, or if you should purchase more.

Here’s How a Florida Independent Insurance Agent Can Help

When it comes to protecting renters against liability risks, property damage, and all other disasters, no one’s better equipped to help than an independent insurance agent. Florida independent insurance agents search through multiple carriers to find providers who specialize in renters insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/802897/average-premiums-for-renters-insurance-usa-by-state/

iii.org

irmi.com

© 2025, Consumer Agent Portal, LLC. All rights reserved.