Even the most professional businesses can still make unintentional errors that cause harm to their customers, or to the public. While these mistakes are already devastating, they can be even worse when your business faces a lawsuit afterwards. That’s what makes having errors and omissions insurance so important.

Fortunately a Florida independent insurance agent can help you get set up with the right errors and omissions insurance for you. They’ll also get you equipped with coverage long before you need to file a claim. But before we jump too far ahead, here’s a closer look at this critical coverage.

What Is Errors and Omissions Insurance?

Errors and omissions insurance, also called professional liability insurance, is a special form of protection for your business that guards against professional errors. Many different professionals need this coverage to protect them against mistakes on the job that could result in customer or other third-party injury or upset.

One example of a professional who needs errors and omissions insurance is a hairdresser, who could get sued if a bad hair treatment injures their customer. In turn, this professional could get sued by the upset/hurt customer. A Florida independent insurance agent can help your business find the right errors and omissions insurance to protect against errors and costly lawsuits.

What Does Errors and Omissions Insurance Cover?

Errors and omissions insurance protects professionals who offer advice or other services to the public that could cause harm, like consultants, lawyers, architects, and even insurance agents. Any of these workers could make unintentional errors that end up hurting their customer, client, or other third party, and in turn get sued for it.

Errors and omissions insurance covers lawsuits brought against your business for claims not relating to bodily injury or personal property damage, which would be covered by a general liability insurance policy. Professional liability insurance is critical to safeguard your company against errors on the job that could otherwise lead to catastrophic monetary losses.

What Doesn't Errors and Omissions Insurance Cover?

Errors and omissions insurance provides a ton of critical coverage for many types of professionals, but it also comes with exclusions. According to insurance expert Paul Martin, the following are common exclusions under errors and omissions insurance policies:

- Intentional and malicious acts

- Staff dishonesty

- Regulatory/statutory penalties

- Bodily injury to third parties

- Personal property damage to third parties

The commercial general liability insurance section of your business insurance policy covers bodily injury and personal property damage claims filed against you by third parties. If you’re concerned about the other coverage exclusions, speak with your Florida independent insurance agent.

How Common Are Professional Liability Claims?

When considering errors and omissions insurance, it’s helpful to know just how frequently businesses get sued for related claims. Check out some recent stats below and see for yourself.

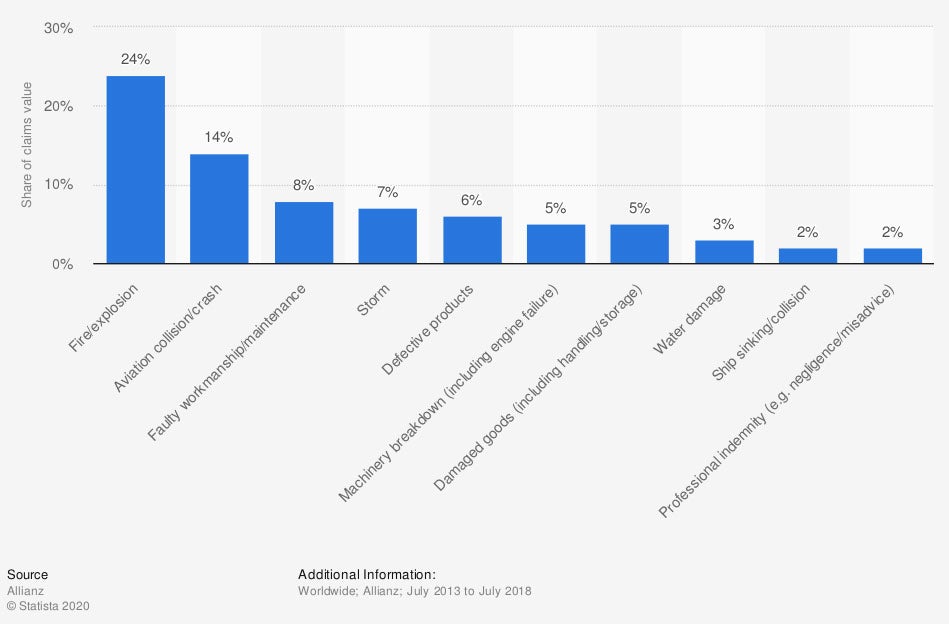

Leading causes of corporate insurance losses worldwide, by share of claims value

By far the leading cause of insurance losses suffered by businesses in recent years are due to fire/explosion, at 24%. Much further down the list are professional indemnity claims (negligence, misadvice, etc.), at 2%.

Though professional errors are far from the most common reasons businesses get sued or lose money, these lawsuits can be extremely costly. Just one lawsuit could bankrupt your business, if you lack the appropriate coverage.

Who Needs Errors and Omissions Insurance?

Basically any professional who could cause harm to the public or their clients/customers through their work services or counseling needs this coverage. If your business is at risk of being sued for something not covered by general liability insurance, you might need errors and omissions insurance.

The following professionals need errors and omissions insurance:

- Accountants

- Attorneys

- Real estate and insurance brokers/agents

- Consultants

- Groomers

- Hair dressers

A Florida independent insurance agent can help you determine for sure whether you require errors and omissions insurance to be safe on the job.

Does Umbrella Insurance Cover Errors and Omissions?

Umbrella insurance is an excess liability policy that can extend the coverage limits provided by the liability sections of business insurance, homeowners insurance, auto insurance, etc. However, this coverage cannot be added on top of professional liability, or errors and omissions insurance.

Umbrella insurance is important to increase your business’s general liability coverage, in case you get sued for claims of bodily injury or property damage. Umbrella insurance is also important for individuals to enhance their home or auto coverage. But unfortunately umbrella policies cannot be combined with errors and omissions insurance.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in errors and omissions insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

graph - https://www.statista.com/statistics/721988/leading-causes-of-liability-loss-worldwide-by-value-of-claim/

https://www.irmi.com/term/insurance-definitions/professional-liability

https://www.iii.org/article/professional-liability-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.