Though convenience stores exist to make things easier for the public, there are a number of risks that the owners must face on a daily basis. When you’re responsible for bringing the goods to the customers, you’ve got to make sure you can keep your business open and operational. That means having convenience store insurance.

Luckily a Florida independent insurance agent can help you find the right kind of convenience store insurance for your specific business. They’ll even get you set up with enough protection long before you need to actually use it. But for starters, here’s a closer examination of this important coverage.

What Is Convenience Store Insurance?

Convenience store insurance is just one type of Florida business insurance geared toward the needs of convenience stores and their owners. Coverage protects the business’s property and inventory, and offers protection from lawsuits and more. A Florida independent insurance agent can help your convenience store get equipped with all the coverage it needs to stay afloat for many years to come.

What Does Convenience Store Insurance Cover in Florida?

Your convenience store has its own unique inventory and risks, and as a result, your policy may be different from the convenience store across town’s policy. However, there are a few basic coverages needed by most stores. These include:

- Commercial property insurance: This aspect of coverage protects your business’s physical structure and contents from hazards like fires, storm damage, and more.

- Workers’ comp: This aspect of coverage protects against employee injury, illness, or death on the job or due to work-related activities.

- Business income insurance: This aspect of coverage protects your business against extended closures that would otherwise lead to lost income and employee wages.

- Commercial general liability insurance: This coverage aspect protects your business against lawsuits filed against it by third parties.

A Florida independent insurance agent will help your convenience store get set up with the important core coverages required, and much more.

What Doesn’t Convenience Store Insurance Cover in Florida?

Convenience store insurance protects your business in numerous ways. However, coverage also comes with a few important exclusions that you need to be familiar with. According to insurance expert Paul Martin, these are some of the most common exclusions under Florida convenience store insurance:

- Flood and earthquake damage

- Dishonest acts by staff and employees

- Business upkeep and maintenance costs

- Nuclear reaction and war damage

For convenience stores in Florida, a state commonly prone to hurricanes and flooding, it’s crucial to consider adding a separate flood insurance policy to protect against natural water damage. Your Florida independent insurance agent can help you find coverage.

Convenience Store Stats for the US

When shopping for coverage for your business, it’s helpful to know the impact of convenience stores on the country overall. Check out some convenience store stats below and keep them in mind before calling up a Florida independent insurance agent.

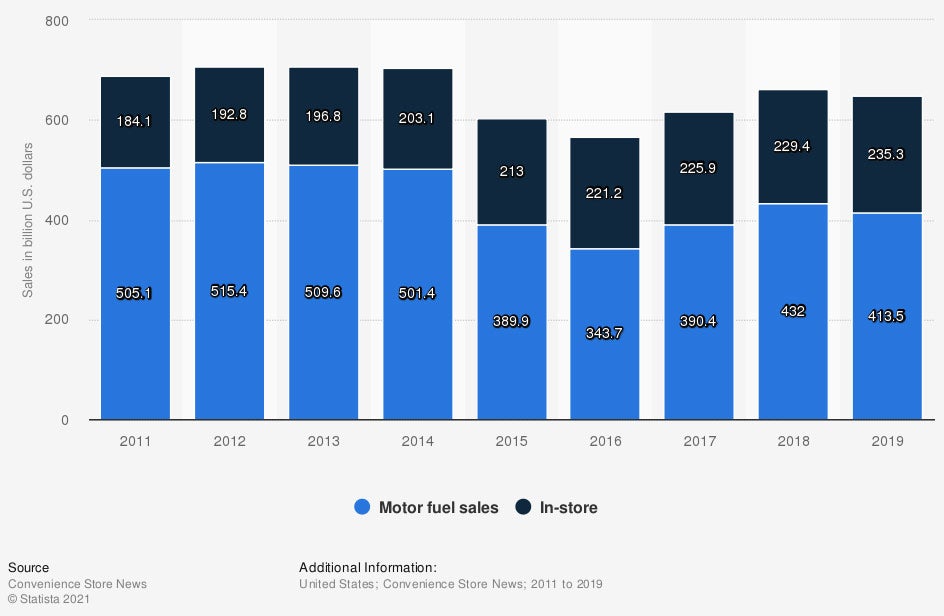

Sales of the convenience store industry in the United States, by format (in billion US dollars)

While motor fuel sales by convenience stores have fallen drastically in recent years as compared to the previous decade, in-store sales have greatly increased. At the beginning of the observed period, in-store convenience store sales amounted to $184.1 billion. Just under ten years later, this amount had skyrocketed up to $243.1 billion.

A Florida independent insurance agent can further explain the importance of convenience store insurance for your unique business.

How Much Does Convenience Store Insurance Cost in Florida?

It’s difficult to estimate the cost of your convenience store insurance policy. That’s because coverage costs are impacted by a handful of factors, each of which differ depending on the specific business in question.

Convenience store insurance premiums are based on:

- The value of your business’s property

- How many employees your business has

- Your annual revenue

- Your business’s size

- Your business’s operations and risk level

A Florida independent insurance agent can help you find exact convenience store insurance quotes for your area, as well as scout out any discounts you may qualify for.

Will My Location Impact My Coverage Rates?

As with many other types of insurance, yes, your location does impact your coverage rates. Convenience stores located along the coast of Florida might pay as much as 15% more for coverage, said Martin. That’s because of the increased risk of storms like hurricanes, which can lead to major property damage and other losses.

Also, convenience stores in larger, richer cities might pay considerably more for their policies than those in smaller towns. Increased risk of crime, as well as higher property values, contribute to this. Your Florida independent insurance agent can tell you the rates for coverage in your area.

Here’s How a Florida Independent Insurance Agent Can Help

Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. Florida independent insurance agents shop multiple carriers to find providers who specialize in convenience store insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/308767/sales-of-the-us-convenience-store-industry-by-format/

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/small-business-insurance-basics

https://www.iii.org/article/small-business-insurance-basics

© 2025, Consumer Agent Portal, LLC. All rights reserved.