One inch of floodwater can cause $25,000 in damage to your Florida home. The easiest way to protect your home is with homeowners insurance.

Not all water damage is reparable so you want to make sure your insurance will pay to replace your home or possessions or reimburse you for losses. A Florida independent insurance agent can make sure you have the proper homeowners insurance and any additional coverages necessary to cover storm damage.

What Is Storm Insurance?

Storm insurance is a type of coverage that is found within your Florida homeowners insurance policy that will pay to repair or replace your home and possessions if they're damaged by a storm.

Within the policy, insurers will list a variety of weather events that are considered a storm. In addition, they outline the specific coverage you'll receive through the policy.

What Does Storm Insurance Cover in Florida?

Under your homeowners insurance policy your storm coverage will include damage from the following weather patterns and events:

- Wind

- Hail

- Lightning

- Fire

- Wind-driven rain or snow

- Falling trees

In the event that one of the above occurs, storm insurance will cover the following:

- Structure of your home

- Furniture

- Heating and cooling systems

- Appliances

- Clothing

- Detached structures such as garages or sheds

- Fences

This is not a comprehensive list of coverages as every policy will vary. Your Florida independent insurance agent can walk you through the coverages that are listed in your policy.

What Doesn't Storm Insurance Cover In Florida?

While your storm insurance coverage within your homeowners insurance will cover some water damage, there are a variety of exclusions if the carrier feels the damage could have been prevented.

Some Florida residents may also experience wind and hail exclusions in their policy because of the coastal location of the state. Your Florida independent insurance agent can let you know if there is a wind and hail exclusion in your policy and help you purchase that coverage.

Storm insurance won't cover any damage that occurs to your vehicle or any business equipment or inventory you keep in your home. You'll need a comprehensive car insurance policy for your vehicle and commercial property insurance for your business if you work out of your home.

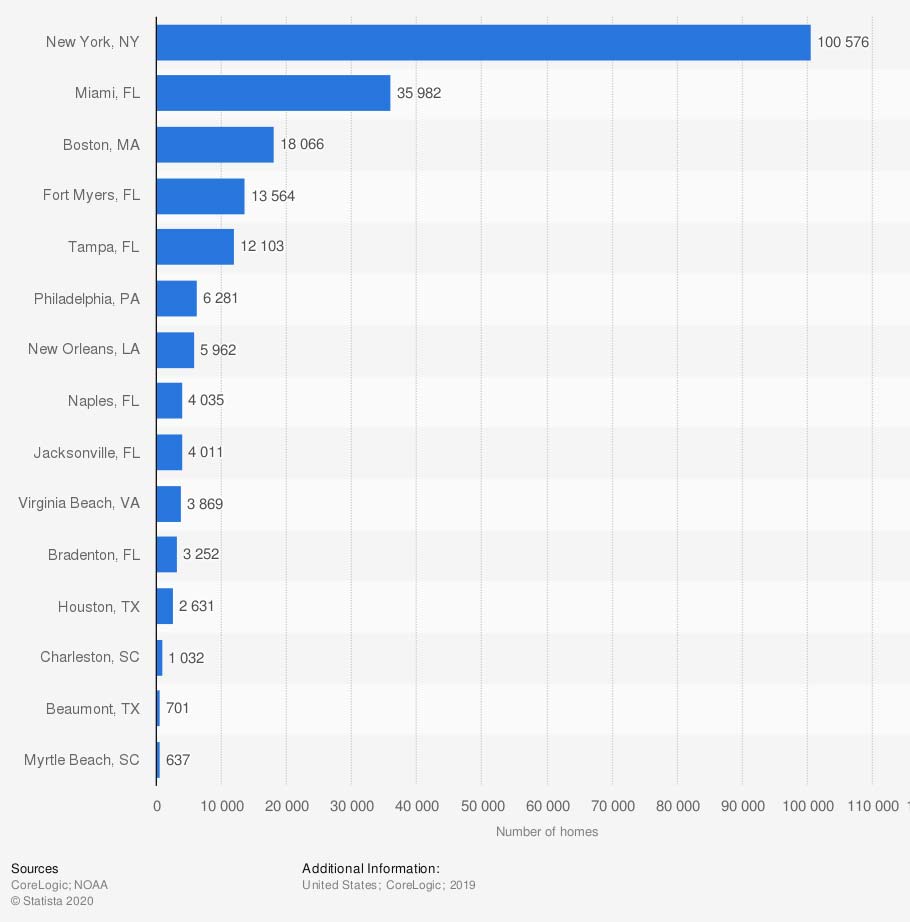

Leading metropolitan areas in the US, by number of multifamily homes at risk of storm surge

Six of the top 15 leading metropolitan areas at risk of a storm surge are located in Florida.

What Other Coverages Should You Get in Florida?

It's no secret that Florida is susceptible to storms. In fact, one in four properties that are at risk of flooding in the US is located in Florida. For this reason, it's important to purchase flood insurance.

Flood insurance can be purchased through your Florida independent insurance agent and the National Flood Insurance Program. "Flood insurance covers buildings up to $250,000 and contents up to $100,000," explained insurance expert Jeffrey Green.

Additional insurance to consider includes:

- Car insurance: To protect any vehicles that you have.

- Business insurance: If you run your business out of your home.

- Wind and hail insurance: If this coverage is excluded under your standard homeowners policy.

Does Storm Insurance Cover Water Damage?

Storm insurance will cover some water damage. The limits for what is covered will be outlined in your policy. Typically, your storm insurance will cover water damage from sudden burst pipes or leaky plumbing.

If the damage is considered "sudden or accidental," your property and possessions will be covered in most cases. However, any damage caused by natural waters will only be covered by a flood insurance policy.

"If you need more coverage than what is offered in the national flood insurance policy, you can purchase additional coverage from private sellers," explained Green.

How Can a Florida Independent Insurance Agent Help You?

Hurricanes and tropical storms are the second-highest leading risk to Florida homeowners. Having the proper storm insurance can help you rebuild your home if it's impacted by a storm.

A Florida independent insurance agent is an expert in homeowners insurance and helping Florida residents find the best coverage. They'll chat with you, free of charge, about your options for coverage and any additional policies you should purchase. Work with an independent insurance agent today.

Author | Sara East

Article Reviewed by | Jeffery Green

Statista image: https://www.statista.com/statistics/1013208/number-of-multifamily-homes-at-risk-of-storm-surge-usa/

https://www.floodsmart.gov/flood-insurance-cost/calculator

https://www.tampabay.com/hurricane/2021/03/14/study-finds-that-floridans-are-underpaying-for-flood-insurance/

© 2024, Consumer Agent Portal, LLC. All rights reserved.