Florida residents are well aware that the state is no stranger to hurricanes. Your personal property needs to be protected against all the harsh elements of these storms, including heavy winds and flooding. That’s why it’s so important to have the right hurricane insurance for your home.

Fortunately, Florida independent insurance agents can help you get set up with the right hurricane insurance for your needs. And they’ll make sure you walk away with all the coverage necessary long before you’d ever need to file a claim. But before we jump too far ahead, let’s take a closer look at hurricane insurance.

What Is Hurricane Insurance?

Florida homeowners insurance actually comes with built-in coverage for “windstorm damage,” which covers damage to your home caused by high winds, including from hurricanes. Florida is also one of 19 states currently required to have a separate windstorm deductible on its homeowners policies. The only aspect of hurricane damage that’s not covered by Florida homeowners insurance is flooding, which requires a separate flood insurance policy.

What Does Hurricane Insurance Cover?

Hurricane coverage is included in your standard homeowners insurance policies in Florida, since the state is so accustomed to these natural disasters being a common issue for residents. Coverage protects your home from damage caused by the high winds and potential hail that can accompany hurricanes. If you want your car to be protected against hurricane damage, you’ll need to purchase Florida comprehensive car insurance.

What Isn’t Covered by Hurricane Insurance in Florida?

According to insurance expert Paul Martin, unfortunately, the built-in coverage for hurricanes in your homeowners insurance policy doesn’t actually cover the flooding portion of these storms. In order to be protected against natural floodwaters, you’ll need to work with a Florida independent insurance agent to get a separate flood insurance policy. Hurricane insurance also does not cover certain other types of natural disasters, like earthquakes and mudslides.

How Costly Is Hurricane Property Damage?

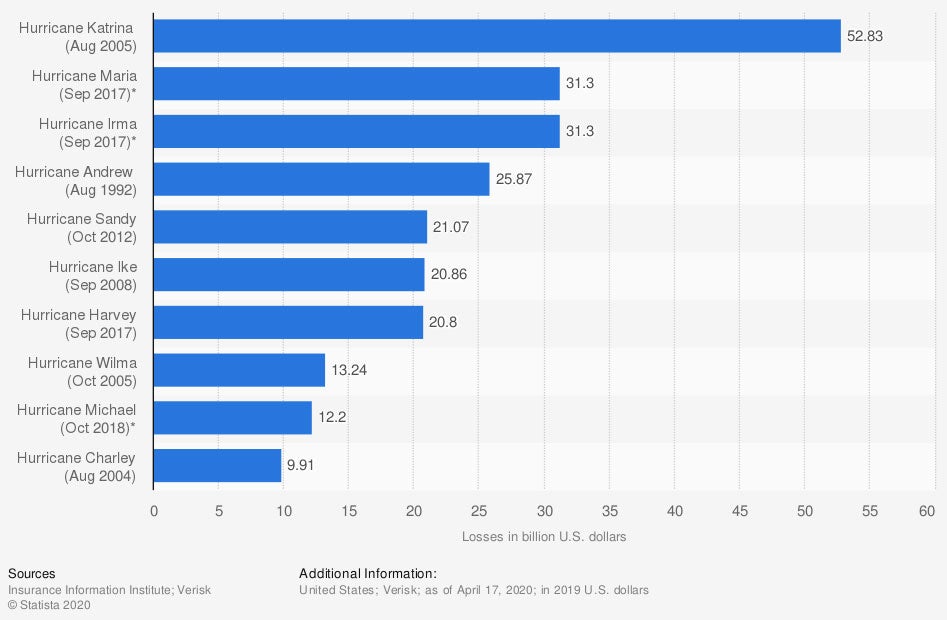

Most expensive hurricanes in the United States as of April 2020, by insured property losses

(in billion US dollars)

Since the turn of the millennium, the US has seen several hurricanes that each cost billions of dollars in property losses. Tied for second place on this list of the costliest hurricanes is Hurricane Irma, which struck in September of 2017 and cost a total of $31.3 billion dollars in property losses. Hurricane Irma heavily impacted Florida’s west coast, along with several other states.

Hurricanes are not only a common threat to Florida residents, but they’re also an extremely expensive one. That’s why it’s so critical to get set up with the right hurricane coverage, ASAP. A Florida independent insurance agent can help.

Do I Need Specific Coverage for My Car against Hurricanes?

Yes, if you want your vehicle to be covered against hurricane damage and damage from other natural disasters, you’ll need a specific coverage called comprehensive car insurance. Comprehensive coverage protects vehicles against high winds and hail, natural flood damage, and much more, like:

- Falling objects

- Missiles

- Collisions with large animals

- Fire and explosions

- Riots or vandalism

- Windshield damage

Without comprehensive car insurance, your vehicle won’t be protected against damage by either major part of a hurricane, the wind or the water. Your vehicle will also be lacking important hail and windshield damage coverage. Speak with your Florida independent insurance agent further about the many benefits of comprehensive car insurance.

How to File a Claim for Hurricane Damage in Florida

To file a claim after a hurricane in Florida, the easiest way is to connect with your independent insurance agent. They’ll be able to get in touch with your insurance company, file the claim for you, and keep you updated on its status after filing. Before you contact your agent, make sure you’re prepared with enough details about the disaster.

After the hurricane, it’s recommended to take photos or video evidence of the damage to your property, whether it’s your home or vehicle, before filing your claim. Your insurance company will probably send an adjuster out to your property to conduct an inspection and determine how much reimbursement you’re eligible for. Your Florida independent insurance agent can walk you through every step of the claims process after a hurricane.

Here’s How a Florida Independent Insurance Agent Can Help

When it comes to protecting homeowners and car owners against hurricane damage losses and other disasters, no one’s better equipped to help than an independent insurance agent. Florida independent insurance agents search through multiple carriers to find providers who specialize in hurricane insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.thezebra.com/homeowners-insurance/coverage/windstorm-coverage/#:~:text=Currently%2C%2019%20states%2C%20plus%20Washington,Carolina%2C%20Texas%2C%20and%20Virginia.

graph - https://www.statista.com/statistics/428934/most-costly-hurricanes-usa-by-property-losses/

https://www.iii.org/article/hurricane-season-insurance-guide

© 2025, Consumer Agent Portal, LLC. All rights reserved.