Residents in Florida are familiar with hurricane threats and other flooding disasters. Without the proper coverage for your home, you could end up in a world of trouble. That’s why it’s so important to be equipped with adequate flood insurance.

Luckily Florida independent insurance agents can help you get set up with the right flood insurance for your needs. They’ll make sure you walk away with all the coverage necessary, long before you’d ever need to file a claim. But before we get too far ahead of ourselves, let’s take a deep dive into flood insurance.

Is Flood Insurance Required in Florida?

It could be, depending on where exactly you live. Those living in high-risk flooding areas are often required to have flood insurance by mortgage lenders. But it’s important to point out that homeowners in other areas might still be required to carry coverage, especially in Florida. It’s always a good idea to just be covered no matter what. Especially because regular Florida homeowners insurance does not provide coverage for damage from natural flooding.

What Does Flood Insurance Cover in Florida?

Your home needs protection from natural flood damage and destruction that your homeowners policy can’t provide. That’s where flood insurance comes in.

Flood insurance in Florida covers the following in 2023:

- Damage to or loss of your home: The structural coverage aspect of flood insurance is designed to protect the foundation of your home, AKA the dwelling, along with indoor plumbing, built-in appliances, electrical systems, and additional flooring from natural flood damage. There may be coverage for sheds and other structures, also.

- Damage to or loss of your stuff: The contents coverage aspect of flood insurance is designed to protect your furniture, non-built-in appliances, some food, valuables, and clothing from natural flood waters.

Keep in mind that flood insurance often takes the depreciation of your property’s value into account when reimbursing for a claim. Certain claims may qualify for the original replacement cost of the item, however. A Florida independent insurance agent can further explain how flood insurance works in different scenarios.

What Doesn’t Flood Insurance Cover in Florida?

According to insurance expert Paul Martin, flood insurance is only designed to cover flooding that stems from natural events, such as hurricanes, tsunamis, heavy rainfall, etc. So, flooding caused by appliances, like a backed-up toilet, won’t be covered.

Flood insurance in Florida tends to exclude the following:

- Mold, mildew, or other moisture damage

- Earthquake or mudslide damage

- Flooding caused by non-natural water events

- Natural flooding events that inundate less than two acres of land

- Property outside of the dwelling like patios, fences, pools, septic systems, and plants

- Additional living expenses*

*Fortunately Florida homeowners insurance provides coverage for additional living expenses if you’re forced to live in a temporary residence while repairs are made to your home after a flood. Your Florida independent insurance agent can help you review other exclusions under flood insurance and help address any concerns you may have.

Flood Stats for Florida

Reviewing just how costly floods are to US residents helps to drive home the true importance of flood insurance. Check out some flood stats for Florida as well as the US overall and see for yourself.

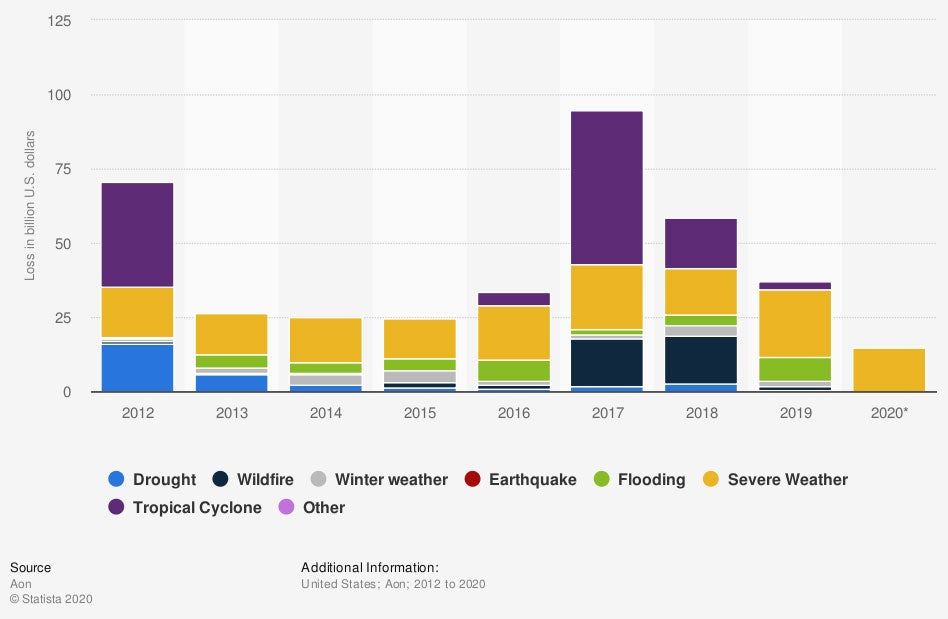

Value of insured losses in the United States from 2012 to 2020, by natural disaster type

(in billion US dollars)

Flooding costs the US billions of dollars in damage almost every year. The two highest insured losses due to flooding over the last decade occurred in 2016 ($7.18 billion) and 2019 ($8.14 billion).

Number of Flood Insurance Claims Per Year

| Florida | 1,765 |

| Kentucky | 1,245 |

| Texas | 9,949 |

| California | 404 |

| Washington | 386 |

Florida has the second-highest number of flood insurance claims per year, falling behind only Texas. Texas’s reported annual flood insurance claim count was a whopping 9,949 total, while Florida’s was 1,765. Perhaps surprisingly, Florida’s flood claims count was over four times as much as California’s, at 404 total.

Flood insurance is important for residents across the map, but it’s especially crucial for Florida residents, given the sheer frequency of flood insurance claims alone. Speak with your Florida independent insurance agent about getting equipped with the right flood coverage ASAP to protect your property.

Does Car Insurance Cover Flooding?

Martin said that Florida auto insurance will only cover flood damage if you purchase a specific kind of coverage called comprehensive auto insurance. It covers flood damage as well as these perils:

- Fire and explosion

- Heavy wind and hail damage

- Vandalism and riot

- Falling objects and missiles

- Collisions with large animals

- Windshield damage

A Florida independent insurance agent can help you get set up with the right comprehensive car insurance for you.

How Much Does Flood Insurance Cost in Florida?

The current annual cost of flood insurance in Florida is $592. But your specific policy’s cost will vary based on your exact location. If you live in a coastal city, your coverage is likely to be more expensive than that of your friends’ located further inland. Florida’s average flood insurance cost is slightly cheaper than the US average of about $700 annually. A Florida independent insurance agent can help you find exact quotes for your area.

Here’s How a Florida Independent Insurance Agent Can Help

When it comes to protecting homeowners and vehicle owners against flood damage losses, no one’s better equipped to help than an independent insurance agent. Florida independent insurance agents search through multiple carriers to find providers who specialize in flood insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.iii.org/fact-statistic/facts-statistics-flood-insurance

graph - https://www.statista.com/statistics/612615/value-of-insured-losses-usa-by-natural-disaster-type/

https://www.irmi.com/term/insurance-definitions/flood-coverage

© 2025, Consumer Agent Portal, LLC. All rights reserved.