Though it’s known for sunshine, Florida is also frequently home to flooding. Because of the frequency in which the state is paid visits by hurricanes and other tropical storms, it’s especially important for residents in Florida to understand flood zones and whether they live or work in one. If you’re in an area at high risk of flooding, it’s crucial to be equipped with the proper Florida flood coverage. But first, check out this guide to identifying and understanding flood zones.

What Is a Flood Zone?

The Federal Emergency Management Agency (FEMA) labels various geographic areas as flood zones based on their estimated flood risk. FEMA determines flood zones by studying storm trends in each location over time and by consulting hydrologist studies. Flooding can occur due to heavy rainfall, melting snow, hurricanes, and other disasters. The way an area is laid out affects how easily water is able to move through and out, which correlates to its risk of flooding.

Flood Damage Statistics in Florida

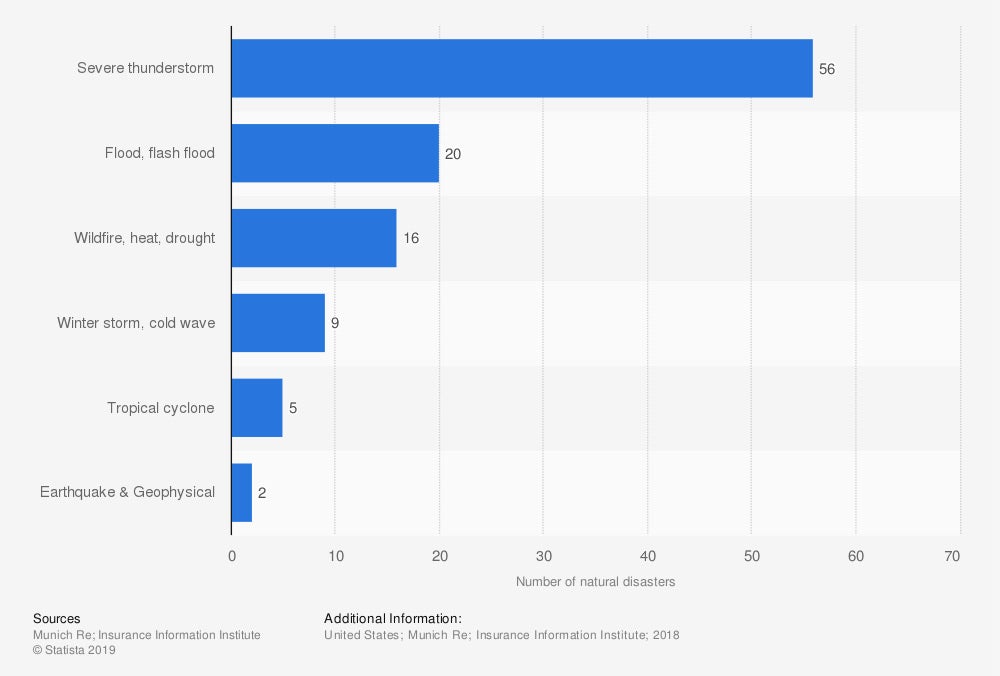

Number of natural disasters in the United States in 2018, by type

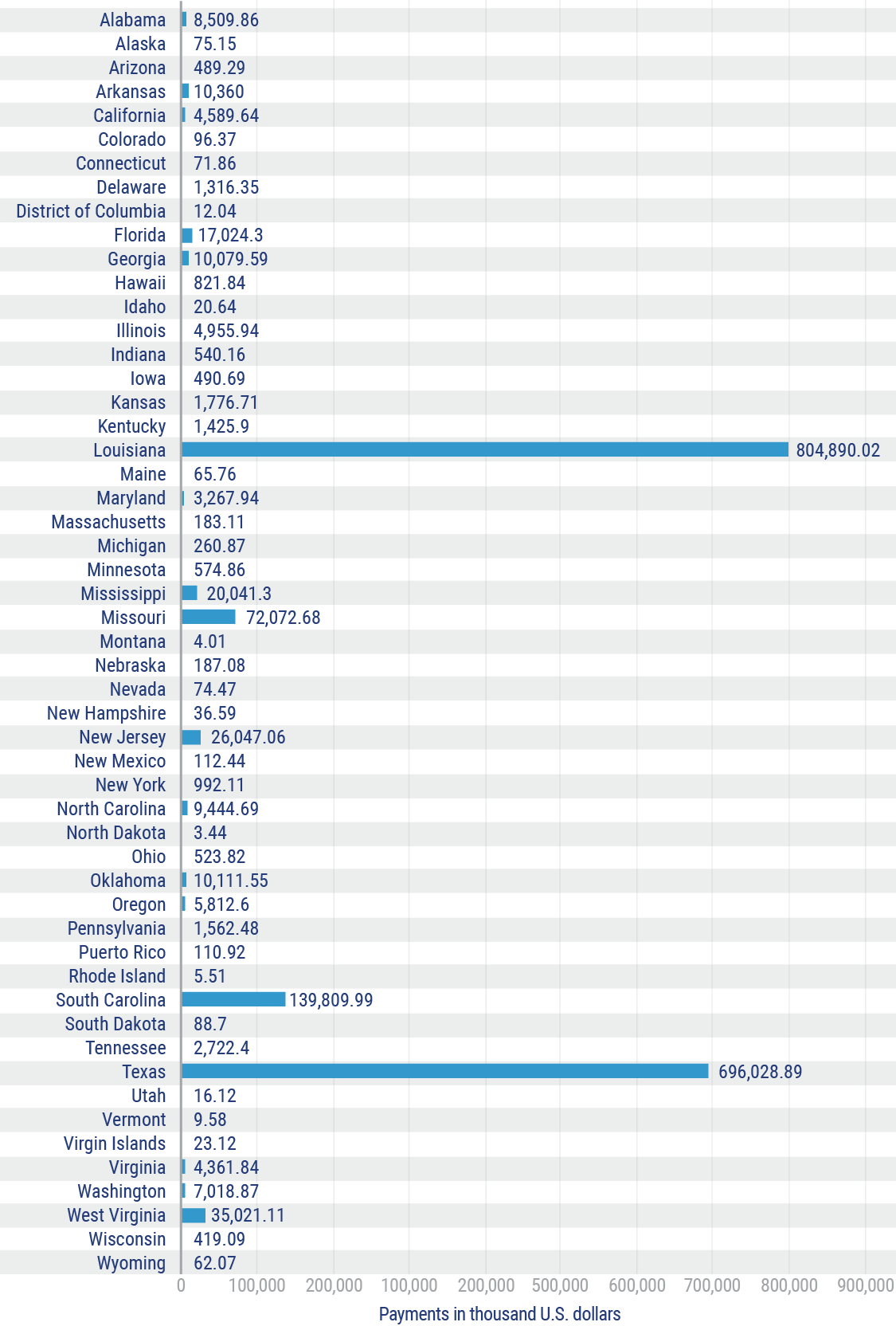

Flood insurance claim payments in the United States from October 1, 2015, to September 30, 2016, by state (in thousand US dollars)

In 2018, floods and flash floods were the second-most common natural disaster in the US, behind severe thunderstorms. Flooding costs the US billions of dollars in damage each year, as well as tragic deaths and severe property destruction.

Some quick and general flood statistics for the US:

- In 2019, flood insurance claims cost the US over $2 billion.

- Flash flooding causes over 200 deaths per year and is the leading cause of weather-related deaths.

- More than half of flood-related deaths occur in vehicles.

- Even properties located in low-to-moderate flood risk areas account for over 20% of flood insurance claims.

- Just one inch of standing water within a home can cause up to $20,000 in damage.

Because of Florida’s unique location along both the Atlantic and Gulf Coasts, the state’s at a much higher risk of flooding than many other areas of the country. Therefore, Florida residents should take the threat of these natural disasters quite seriously.

Here are some quick flood statistics for Florida:

- As of 2020, more than 2.1 million Florida residents are flood insurance policyholders.

- More than two-thirds of the US’s flood insurance policyholders reside in Florida.

- Florida’s relatively flat landscape makes it especially easy for flooding to escalate and spread.

- Florida has the longest seacoast in the continental US, making its risk of flooding extreme.

- Florida is home to the most expensive coastal real estate in the country, making property damage from flooding astronomically expensive in the Sunshine State.

- By 2030, roughly $69 billion worth of coastal properties will join those at risk of flooding.

- By 2050, this value of added at-risk coastal properties will increase to about $152 billion.

Do You Need Flood Insurance?

Click to Get a QuoteUnderstanding Flood Zones in Florida

In order to better prepare for flooding, it’s a good idea to find out if you live or work in a flood zone. Florida’s flood zones are determined by FEMA according to various criteria and are marked on the official website’s map.

Here is a key for understanding official flood zones in Florida:

- A-Zones: These indicate inland flood zones. These areas are not located along the coast, but are still at risk of flooding.

- V-Zones: These indicate beach zones, and are areas commonly struck by waves and storms. They carry a much higher risk of flooding. Obviously in a state like Florida, there are tons of V-Zones.

- X-Zones: These indicate areas that are remote or not expected to flood. That being said, 30% of all FEMA’s payouts for flood damage go to properties within these zones.

You can easily locate your specific flood zone through FEMA’s Map Service Center on their official website. Just input your address to view your community’s map. It’s important to determine not only your specific zone, but also the surrounding zones and any potentially hazardous areas near you.

What Are the Most Flooded Areas in Florida?

While it’s easy to pull up an official map online, it’s also helpful to be familiar with areas of your state that are famously prone to flooding. Florida has a few flooding hotspots that you may want to avoid in times of heavy rainfall or impending tropical storms, such as:

- Miami

- Sarasota

- Tampa

- Pensacola

- Jacksonville

- Daytona

- Palm Beach

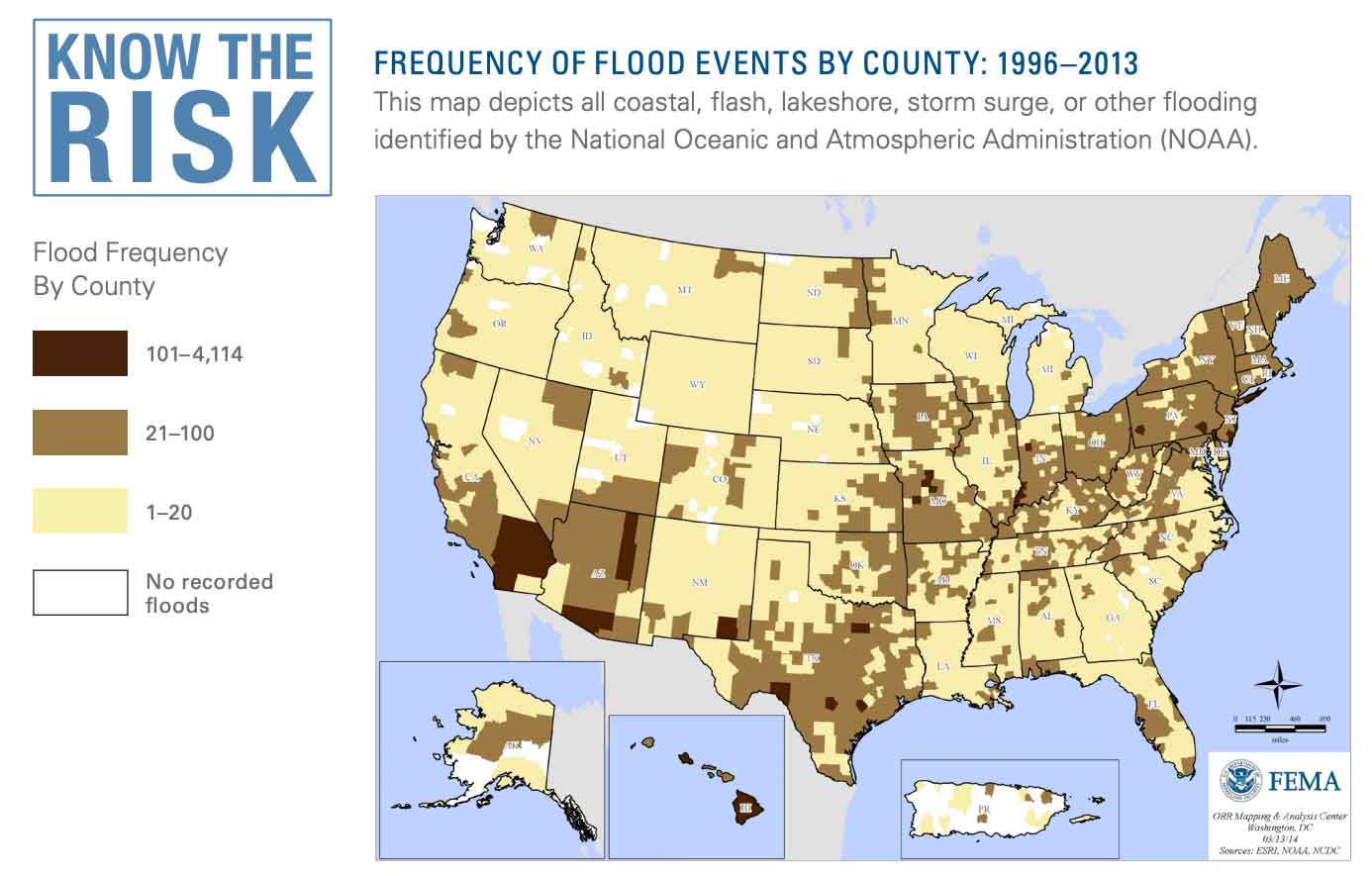

That being said, pretty much the entire state is at risk of flooding. Check out this map from FEMA, indicating the flood frequency per county in each state:

While much of Florida falls into the 1-20 range, several counties are nestled in the 21-100 range, and several still fall into the 101-4,114 range. So, while knowing your specific flood zone is important, in a state like Florida, it’s best to be prepared for flooding no matter where you reside.

Is Flood Insurance Required in a Flood Zone?

Typically, properties located within A or V flood zones as designated by FEMA require their owners to carry flood insurance. Since these zones include not only beachfront and coastal properties but also those within areas otherwise prone to flooding, having adequate flood protection is crucial. Even properties located within low-to-moderate risk areas should consider getting coverage, especially in a coastal state like Florida.

Flood insurance covers the following:

- Damage to your home: This includes the foundation of the structure, electrical systems, indoor plumbing, built-in appliances, and additional installed flooring, like carpeting.

- Damage to your stuff: This includes furniture, certain appliances, some food, valuables, and clothing.

Flood insurance also covers total destruction of your home or personal property by flood waters, up to your policy’s limit.

Why Work with a Florida Independent Insurance Agent?

In order to get the protection you need and deserve, you’ll want to work with a trusted expert. And who could be better for the job than a local agent who shares your area code? Independent insurance agents act as your own personal insurance shoppers, offering you tons more options than one-policy companies. With just one call, they’ll hook you up with multiple quotes.

Florida independent insurance agents are armed with knowledge on what coverage is needed in your area, and they’ll get you set up with just enough of it — not too little, not too much. They’ll handle all the heavy lifting so you can rest assured you’ll be set up with the right coverage at the right price.

They’re not just there at the beginning either. If disaster strikes, your Florida agent will be there to help walk you through the claims process and make sure you’re getting the benefits you're entitled to. Now that’s thinking ahead.

Article Reviewed by | Paul Martin

fema.gov

iii.org

floodsafety.com

© 2025, Consumer Agent Portal, LLC. All rights reserved.