When you own a small business that employs staff, there's a sense of ownership that takes place. While it may be nice delegating tasks and having the help, you'll need proper protection to avoid a loss. Florida workers' compensation insurance can cover your exposure as a boss.

A Florida independent insurance agent will do the shopping for you at no additional cost. In addition, they have a network of carriers, saving you time and premium dollars. Connect with a Florida independent insurance agent for custom quotes to get started.

What Does Workers' Compensation Insurance Cover in Florida?

In Florida, there are 2,500,000 small businesses in operation. When you run a company that has employees, you'll want the right protection in place. Workers' compensation can help protect your business from financial ruin.

- Workers' compensation insurance: Pays for the medical expenses and lost wages of an employee who gets injured or becomes ill on the job. Some policies will pay for disability, and even death benefits, for an employee as well.

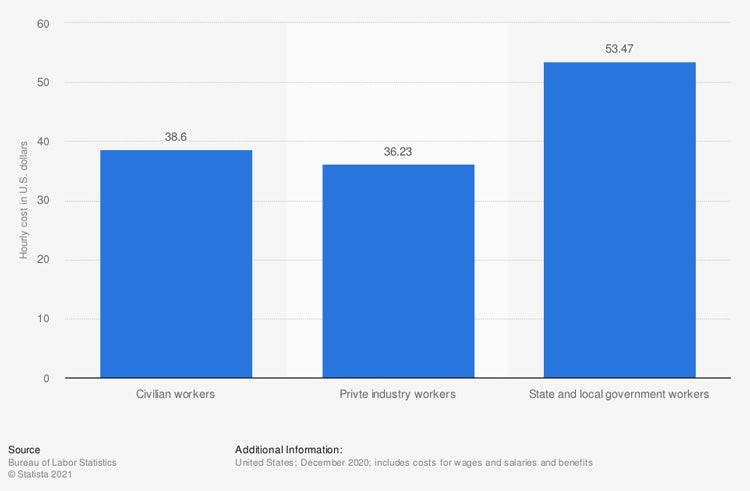

Average employer costs for employee compensation in the US, by ownership (in US dollars)

The salaries you pay your employees will continue to be your expense if they are injured at work and you don't have workers' compensation coverage. Imagine paying for the wages of an employee that can't work due to an injury.

How Much Does Florida Workers' Compensation Cost for a Small Business?

A Florida small business has to keep a close eye on its annual expenses. The cost of your workers' compensation insurance can add up if you're not careful. Insurance companies use several risk factors when determining your premiums. Check out the things carriers consider when rating your policy:

- Classification codes: Every job duty is assigned a code that underwriters use to rate policies.

- Prior losses: If you have previous claims, carriers take that into account when rating your policy.

- Years in operation: The longer you've been in business, the better premium carriers will give you.

How Many Workers' Compensation Claims for Small Businesses Occur?

Workers' compensation claims can happen to any business with employees at any time. But if you're without proper protection, you could find yourself paying for a pile of medical bills and lost wages.

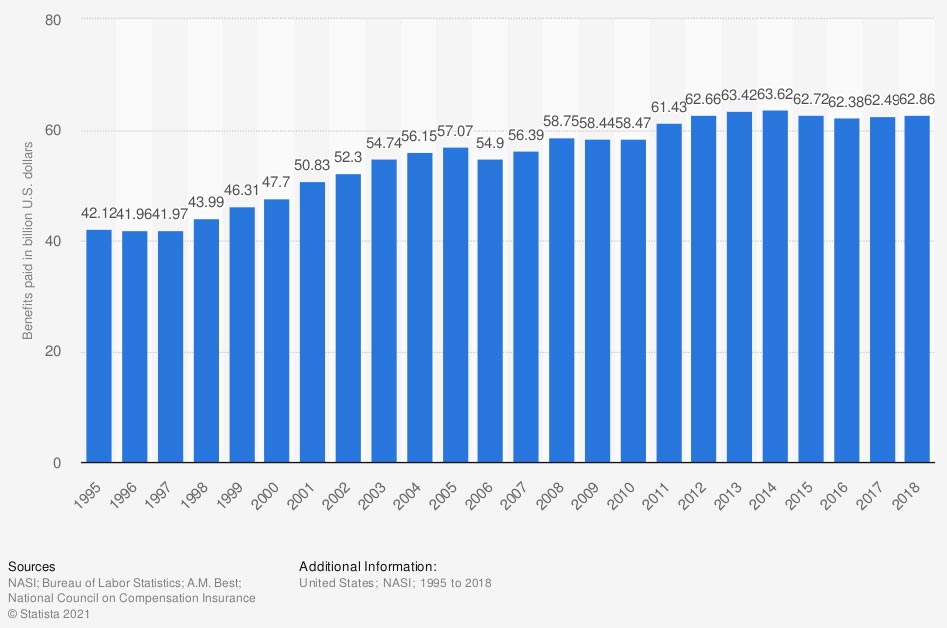

Value of workers' compensation benefits in the US (in billion US dollars)

The amount of workers' compensation benefits in the US is alarming. If you're without a policy and have a team, you could be in a mess of financial trouble.

Where Can You Purchase Workers' Compensation Coverage in Florida?

In Florida, you'll be able to purchase your workers' compensation insurance one of two ways. You can use an agent or go through the state pool. The state portal will be the worst coverage you can get at a high price. However, everyone has to go through the state if they are a new operation.

When you've had workers' compensation coverage for, typically, three years, you can get coverage through a standard carrier. This will afford you better rates and more coverage options.

How a Florida Independent Insurance Agent Can Help

When you're a small business, you don't have the resources that big corporations do. So if you can save on your workers' compensation insurance in Florida, you should. While all rates are different and based on your employees and operation, a professional can help get you a lower premium.

If you work with a Florida independent insurance agent, they shop through their A-rated carriers for free. From there, they'll present the best and most competitive options for your company. Connect with a local expert on TrustedChoice.com to get started in no time.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/1126337/us-employer-costs-for-employees-by-ownership/

https://www.statista.com/statistics/194854/us-workers-compensation-benefits-paid-per-year/

http://www.city-data.com/city/Florida.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.