The cost of insurance for your company can be a large expense. When you run an operation, you'll have to work in the price tag for protection. Florida commercial insurance can have coverage for your lawn care business, giving you the best policy in town.

A Florida independent insurance agent will do the shopping for you at zero cost to your company. They have a network of carriers so that you'll have options. Connect with a local expert easily and get started.

What Is Lawn Care Business Insurance?

In Florida, there are a ton of lawns to maintain all year round. Therefore, the right coverage is necessary to avoid financial risk. Check out standard insurance options for a lawn care business below:

- General liability: Pays for a bodily injury or property damage claims.

- Commercial umbrella liability: Pays for additional liability protection when your underlying limits have been exhausted.

- Workers' compensation: Pays for medical expenses and lost wages of employees hurt on the job.

- Business auto: Pays for an accident or loss involving a company vehicle.

- Business property: Pays for replacement or repair of any property owned by the company.

- Business equipment breakdown: Pays for replacing or repairing equipment that breaks down due to a covered loss.

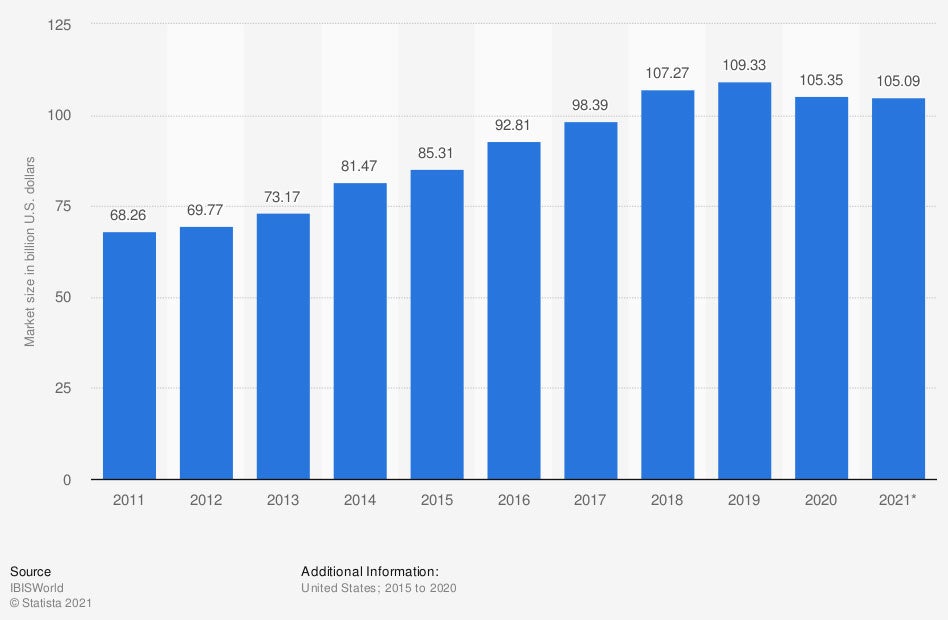

Market size of landscaping services in the US from 2015 to 2020 with a forecast for 2021 (in billion US dollars)

The market for lawn care in Florida is high in demand. You'll want to understand how to protect your equipment and operation from losses that could occur.

What Does Lawn Care Insurance Cover in Florida?

In Florida, there are 2,500,000 small businesses in existence. Lawn care companies will need their own specific coverages. Some standard losses automatically included are fire, natural disasters, theft, and vandalism.

Common losses covered under Florida lawn care insurance:

- Coverage for bodily injury or property damage claims

- Coverage for business property and equipment in transit

- Coverage for hazardous chemicals used

- Coverage for your business inventory such as products

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

What Doesn't Lawn Care Insurance Cover in Florida?

There are multiple items your lawn care insurance policies may not cover. Some coverages can be added in for additional premium, while others are excluded altogether. Check out what could be missed under your Florida lawn care policies:

- Drive other car insurance: This can generally be added to your commercial auto policy but is not automatic. It would give a dollar amount of coverage towards another vehicle that the owner or the owner's family members rented or used that's not already on their policy.

- Employment practices liability insurance: This coverage is not included but can usually be added. It would help pay for a discrimination lawsuit filed by an employee.

- Employee vehicles: If you allow your employees to use their cars when going from job site to job site, that isn't usually covered under your policy. It can be added, and should if this is a practice.

How Much Does Lawn Care Business Insurance Cost in Florida?

Florida lawn care insurance costs will vary and depend on several items. Carriers look at numerous risk factors when calculating your insurance premiums. Take a look at what companies consider when quoting:

- Loss history

- If you use chemicals

- If you have employees

- Equipment you own

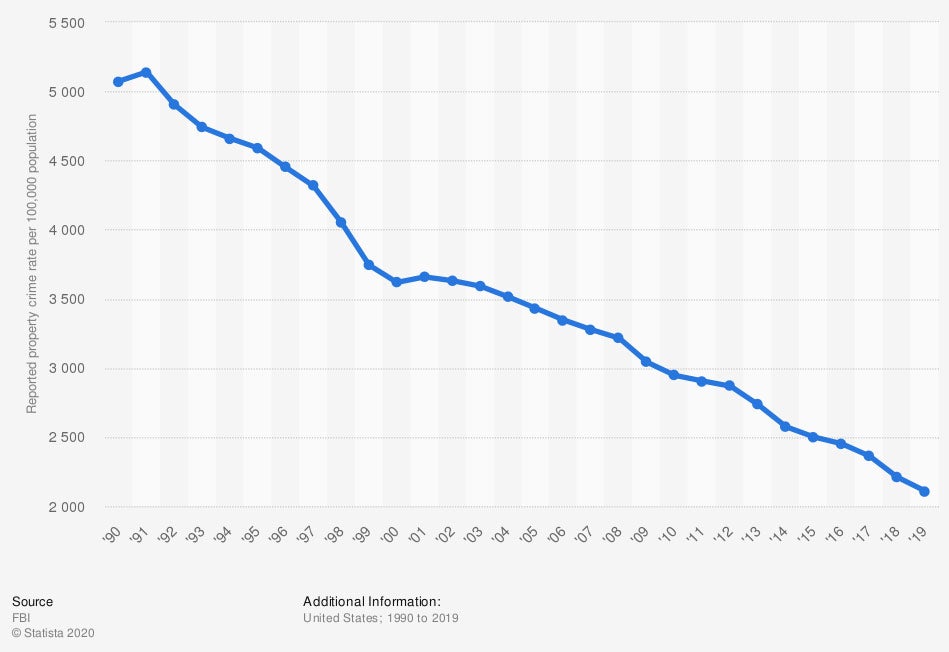

- Local crime rate

Will My Florida Location Impact My Rates?

Since most lawn care companies are on the move, then a physical location may not be a factor. However, the territory and radius in which you operate your business are. Take a look at what could affect your rates based on the area where you operate:

- Local crime rate

- Local natural disasters reported

- Local claims reported by other insureds

- Flood zone assigned

- Property in-transit

- Radius traveled

Reported property crime rate in the US from 1990 to 2019

If you're concerned about how much your premiums will be based on location, talking with an adviser can help. They'll run numbers on how much your lawn care policies will cost.

How an Independent Insurance Agent Can Help in Florida

The best lawn care business insurance can be obtained quickly and easily if you know where to look. Since there are multiple policies on the market, it could be confusing to understand what's necessary for your operation. Fortunately, a licensed professional can help you shop and review coverage, all for free.

A Florida independent insurance agent works with several carriers at once so that you're presented with options. They'll do the hard part and get you affordable coverage. Connect with a local expert on TrustedChoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/294212/revenue-of-landscaping-services-in-the-us/

https://www.statista.com/statistics/191237/reported-property-crime-rate-in-the-us-since-1990/

http://www.city-data.com/city/Florida.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.