In Florida, there were more than $34,546,451,000 in homeowners insurance claim payouts in one recent year. Should a catastrophe hit your home, do you know what your insurance will cover?

Knowing what exposures you have from your homeowners insurance means you can work with a Florida independent insurance agent to fill any gaps.

What Doesn't Homeowners Insurance Cover In Florida?

The average Florida homeowner will pay $1,951 for homeowners insurance. With the 2nd highest average premium in the nation, it's important to know what your money gets you.

Your homeowners insurance policy provides several benefits:

- Pays to repair or replace your home and belongings after fire, wind, hail, burglary, or similar events.

- Covers any liability claims for third-party injuries or property damage that happen at or in your home.

- Provides adequate living expenses if you need to temporarily move out of your home.

While comprehensive, your Florida homeowners policy won't cover all situations. It won't cover:

- Damage from flooding or earthquakes

- Maintenance damage from general wear and tear

- Damage from nuclear war or hazards

- Specific valuable property may not be covered or have limited coverage

- Intentional damage

- Your vehicle

Your Florida independent insurance agent can help you find a homeowners insurance policy that fits your needs. Many gaps in coverage can be covered through riders and endorsements that your agent can help you purchase.

What Extra Coverage Do You Need in Florida?

Some Florida homeowners insurance exclusions will never be covered, but others can be supplemented with additional insurance.

For Florida residents, it's particularly important to purchase flood insurance. Several Florida cities are considered very likely to flood from natural waters, and the only way to get coverage for your home is through a flood insurance policy.

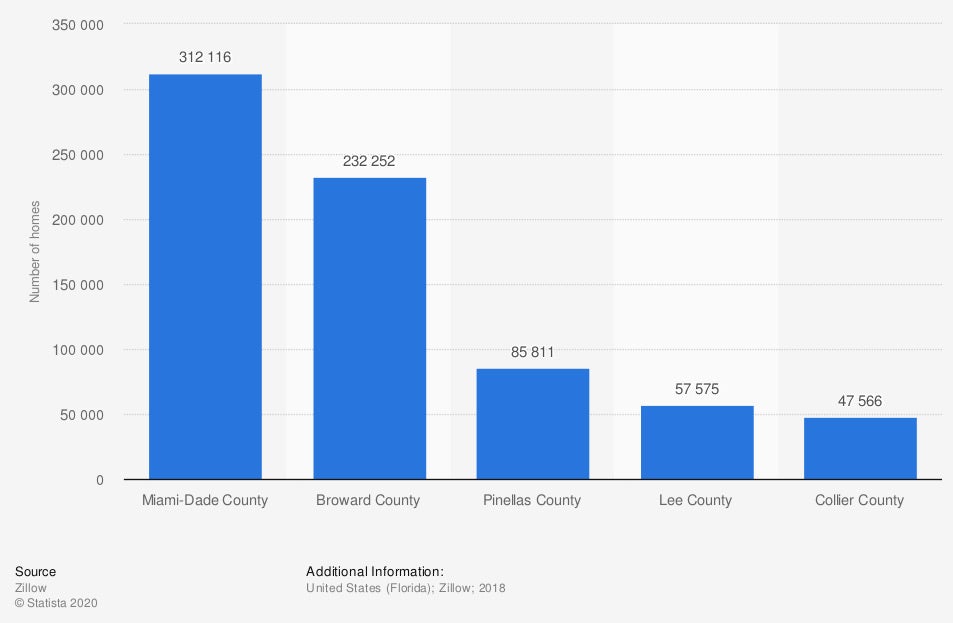

Number of homes at risk of annual coastal flooding in Florida, by county

Hundreds of thousands of homes are at risk of flooding across the state of Florida.

Additional coverages to consider

- Home business insurance: If you run your business out of your home, you'll need separate insurance coverage for your office files and equipment.

- Auto insurance: Homeowners insurance will not cover your vehicle if it is damaged. If you have business vehicles, you should consider purchasing commercial auto insurance as well.

- Sinkhole insurance: Residents of west-central Florida are at risk of experiencing sinkholes.

Your Florida independent insurance agent can help you find and purchase additional coverages that you need for your home.

How to Find Flood Insurance in Florida

Flood insurance is offered through the National Flood Insurance Program (NFIP). Under this program, run by FEMA, the NFIP partners with insurance companies across the US, and thousands of independent insurance agents to offer affordable flood insurance.

Under this coverage, you'll receive $250,000 for the building and $100,000 for contents of your home.

"If you need more coverage, you can purchase additional private coverage," explained insurance expert Jeffrey Green.

Your insurance agent can work with you to determine your risk of flooding and how you can purchase flood insurance.

How to Find Liability Coverage in Florida

Your standard Florida homeowners insurance will include personal liability coverage. Under this portion of your policy, you'll be protected against claims for third-party property damage and bodily injury that occur at your home or on your property.

When you sit down with your Florida independent insurance agent, you can discuss policy limits and whether you need more coverage.

Your agent will include your liability needs when speaking with insurance carriers to build your homeowners package.

How a Florida Independent Insurance Agent Can Help You

More than 21 million people call Florida home. Whether you're a new homeowner or are reevaluating your insurance coverage, a Florida independent insurance agent is an expert in homeowners insurance.

For no cost, they'll speak with you about your home and your insurance needs. They'll use their network of insurance carriers to shop multiple quotes and find you an affordable rate. When the time comes to evaluate your coverage, they'll help you through that process and can provide insight on any gaps or additional coverage you should consider.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www.foundationprosfl.com/floridas-sinkholes/

https://www.census.gov/quickfacts/FL

https://www.floodsmart.gov/flood-insurance/types

Geo data: homeowners insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.