Life insurance is designed to pay a large sum of money to someone when you pass away. However, with certain policies, you can end your life insurance contract early and receive a cash payout, referred to as the cash surrender value.

The easiest way to understand cash surrender values is to work with a Florida independent insurance agent. If you're looking for a life insurance policy with a cash account component, they're the right place to start.

The average life expectancy in Florida is 80 years

What Is Cash Surrender Value?

When you purchase a permanent life insurance policy, you are committing to a policy that lasts your entire life. However, you can choose to surrender your policy while you're still alive.

The amount of money that you receive when you choose to voluntarily terminate or surrender your life insurance policy before you pass away is referred to as the cash surrender value.

How Does a Cash Surrender Work in Florida?

Life insurance policy options include term or permanent policies. If you purchase a permanent policy, it comes with a savings account component. With this account, you can add cash that can earn interest after your premium payment is made.

A benefit of the cash value of a savings account is that you can choose to borrow against it or take some or all of it out of the account before you die.

When you choose to surrender your policy you are cashing out. Universal and Indexed policies will have a surrender charge for terminating your policy early, but the remaining cash value minus the surrender charges is how much of a cash surrender value you would receive.

Florida resident life insurance habits

How to Calculate Cash Surrender Value of Life Insurance in Florida

Every person's cash surrender value will vary depending on multiple factors.

- At what age you purchased your life insurance policy

- Premium costs

- Amount of money you contribute to your policy

- Percent of interest earned

To calculate the cash surrender value of your life insurance policy, you would take the total amount of money you've contributed into your policy and your accumulated earnings and subtract any prior withdrawals and outstanding loans.

You can learn more about calculating your cash surrender value by talking with your Florida independent insurance agent.

How to Calculate Cash Surrender Value of Term Life Insurance in Florida

A term life insurance policy is designed to pay out to a beneficiary should you die within a determined time frame. For this reason, term life insurance does not include a cash savings component and therefore does not have a cash surrender value.

"Cash surrender value doesn't exist for term insurance," confirmed insurance expert Paul Martin. "You must have a universal or whole life insurance policy and it works the same way for both. You will receive a little more flexibility with a universal policy, which your independent insurance agent can explain."

Am I Currently Overpaying on My Cash Surrender Value?

There is no recommended amount of cash that you should be putting into a life insurance cash savings account. Determining the right amount of money for you should be based on your intentions with the life insurance policy and your other saving habits.

Using life insurance as an additional cash saving is only recommended as a long-term strategy. The earlier you cash out the higher the fees will be. In addition, the cash value will build over time.

Your Florida independent insurance agent can help you determine a comfortable amount of cash to contribute to the cash value of your policy.

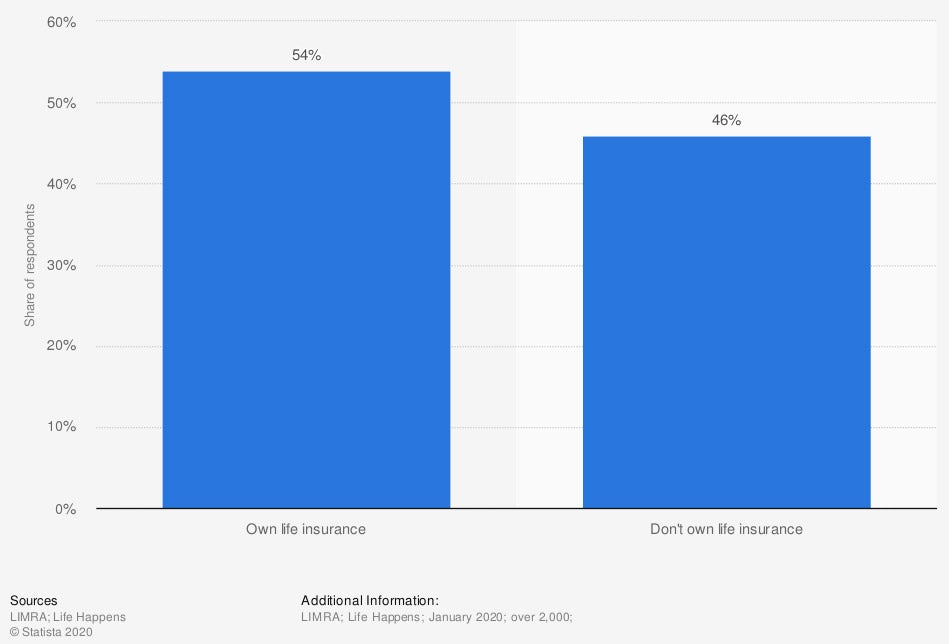

Ownership of life insurance policies in the US

54% of Americans have life insurance.

How a Florida Independent Insurance Agent Can Help You

Life insurance can be used for a lot more than end-of-life planning. A Florida independent insurance agent is an expert in life insurance and the variety of options it provides you and your family.

Talk with an agent, free of charge, to learn about permanent life insurance options and how you can start building a cash savings through your life insurance policy.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/374992/life-insurance-purchases-in-the-us-by-states/

https://www.statista.com/statistics/194426/total-us-life-insurance-payments-to-beneficiaries-by-state/

https://www.statista.com/statistics/194406/us-group-life-insurance-payments-to-beneficiaries-by-state/

https://www.statista.com/statistics/455614/life-insurance-ownership-usa/

https://www.iii.org/article/what-are-surrender-fees

© 2024, Consumer Agent Portal, LLC. All rights reserved.