Car insurance is required by law in Florida, but there are a variety of policies you can choose from. For drivers hoping to get affordable but comprehensive coverage, it helps to understand exactly what goes into calculating Florida car insurance premiums.

Fortunately, a Florida independent insurance agent is an expert in all things car insurance. They can help you shop policies and understand where you can save money. To start, here's how car insurance is calculated in Florida.

What Is the Average Cost of Car Insurance In Florida?

Florida is one of the more costly states to be a registered driver. The average Florida driver will pay $1,742 in car insurance every year. This is $431 above the national average, and the fifth costliest state for coverage.

However, Florida is one of two states that does not require bodily injury liability insurance for drivers. Every driver must have property damage liability and personal injury protection.

How to Calculate Car Insurance In Florida

Car insurance writers look at a variety of factors when considering the cost of auto insurance. It boils down to how many risks the driver presents when behind the wheel.

"The liability that insurers are taking into consideration has nothing to do with the car," explained Paul Martin, insurance expert. "The liability is all about the primary driver of the vehicle and how good a driver they are."

Common factors considered when calculating car insurance premiums:

- Gender

- Age

- Driving record

- Occupation

- Whether you drive for work or pleasure

- Annual miles driven

A Florida independent insurance agent can provide insight and quotes on your car insurance based on your potential risks as a driver.

How to Calculate in Additional Policies

Car insurance is a combination of liability and property damage. We already discussed how the liability portion of insurance is calculated, but the property damage portion is based on the risks of physical damage to the vehicle.

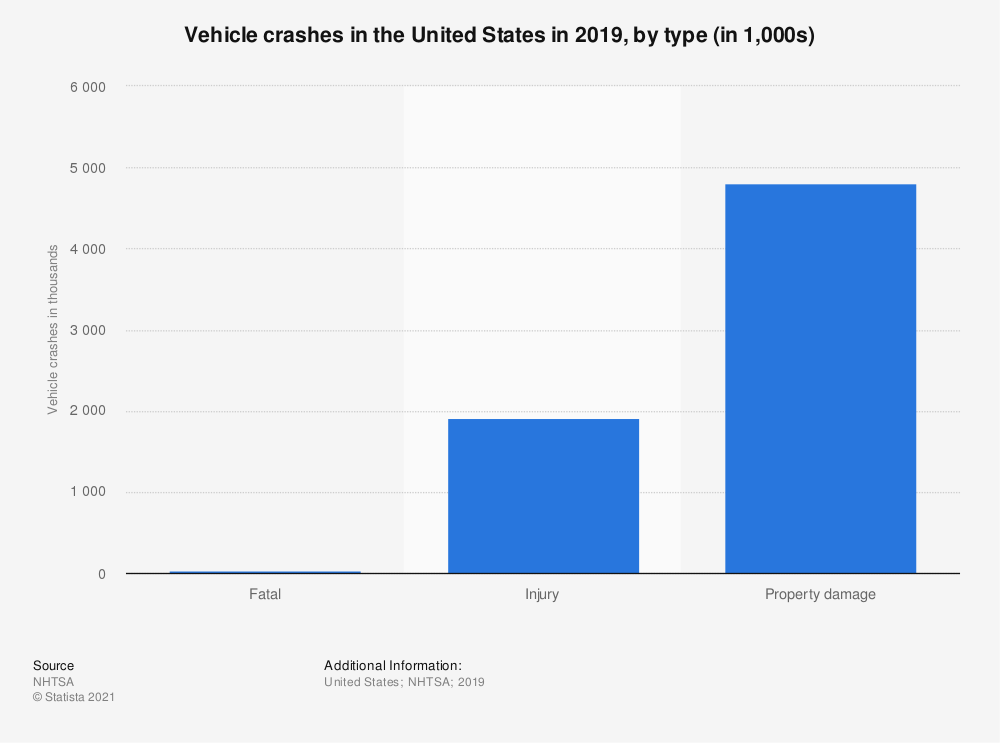

Vehicle crashes in the US, by type

Property damage crashes are more than twice as common as injury or fatal accidents. The most common additional policies added to auto insurance are collision coverage, comprehensive coverage, and uninsured motorist.

"When calculating the physical damage, that's about the driver and the car," said Martin. When taking the car into consideration, insurers will consider the make and model, year, safety features, and what it would cost to replace the vehicle.

What Drives Car Insurance Premiums Up?

There are a variety of reasons that one person's car insurance may be more expensive than another's. The biggest impacters of premiums include:

- Age: Drivers under 18 and over 65 have higher insurance premiums.

- Driving history: Previous incidents and accidents will increase rates.

- Miles driven: The more often you drive, the more likely you are to get in an accident.

- State requirements: More required coverage results in higher premiums.

- Make and model of the vehicle: The safer the vehicle, the less likely an accident and costly damage.

How Can I Save Money on My Florida Car Insurance?

Fortunately, there are many ways to save money on car insurance. The easiest is working with a Florida independent insurance agent, who can shop multiple carriers for you.

Your agent will also look into the following opportunities for you to save:

- Bundling: Most companies offer a discount if you bundle your Florida home insurance with your car insurance.

- Good driver discounts: Many companies will offer discounts to drivers with a clean driving record.

- Driving classes: Defensive driving courses are offered by most insurance companies.

- Low miles: Driving less lowers your chances of an accident.

How a Florida Independent Insurance Agent Can Help You

Car insurance can protect you from severe financial losses in the event of an accident. Shopping around is a crucial step in finding the best price available. A Florida independent insurance agent can price different packages and policies that fit your needs.

Agents will chat with you, free of charge, to learn about your vehicle and your insurance needs. Work with an agent today to find a Florida car insurance policy.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/191499/vehicle-crashes-by-severity-in-the-united-states-since-1991/

© 2024, Consumer Agent Portal, LLC. All rights reserved.